By Christina Derlath, Director of Finance

Christina Derlath has extensive experience in project finance and tax in the renewable energy industry.

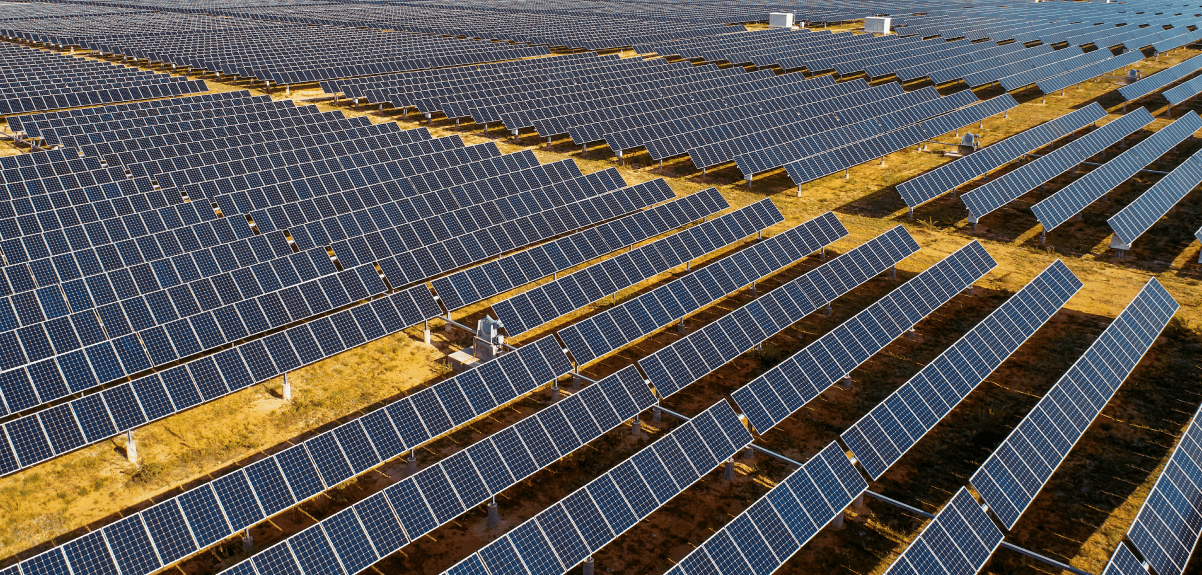

Financing a utility-scale renewable project can be an arduous and intricate process. Utility-scale renewable projects involve many moving pieces and incur their share of financial risks, but they also present sponsors with unique opportunities to generate revenue while creating clean, renewable energy. Project finance moves crucial renewable energy projects forward while protecting a sponsor’s assets. Through project finance, sponsors and investors can capitalize on the vast financial opportunities such projects provide while minimizing risks.

One of the things that makes renewables a sound investment is the fact that solar energy and wind power comes from natural processes that are constantly replenished. The sun will continue to shine, and the wind will continue to blow, providing us with a resource that is virtually inexhaustible. As our country continues to strive towards its clean energy goals, the renewable industry continues to grow, while renewable infrastructure becomes more affordable.

With the passage of the Inflation Reduction Act (IRA), there will be more opportunities for those looking to develop long-term renewable energy assets. The IRA’s extensive tax credits provide much greater market certainty for sponsors of renewable projects and will influence project finance for the foreseeable future.

Breaking Down Project Finance

Energy projects could not come to fruition without project finance. During the project financing process, lenders assess a project’s risks and future cash flow, loaning money to develop the project. To protect the sponsor’s other assets, sponsors set up an independent company with an independent balance sheet for each project. This way, if something goes wrong, the sponsors other assets are not at risk and lenders have little to no recourse to the sponsor.

In a project finance structure, three players come together to make up the capital stack:

- The cash investor –The sponsor, the cash investor on the project, builds the project, arranges debt, and raises tax equity.

- The tax equity investor – This investor monetizes all the tax benefits, including tax depreciation and credits.

- Debt – The lender loans money to the sponsor to support specific projects typically at the level above the tax equity partnership (i.e., back-leverage).

Depending on their risk appetite, project sponsors may choose to invest in a renewable project at different phases of the project lifecycle. Each key stage of utility-scale renewable projects come with unique risks and returns:

- Development – Consisting of land acquisition, interconnection, permitting, and offtake, the development phase offers the highest risks and highest rewards for sponsors. Few projects actually survive the development phase. However, sponsors that invest in a project during the development phase realize high returns if the project succeeds.

- Construction – Consisting of building and installing the project infrastructure, the construction phase offers sponsors an opportunity to charge a construction premium for building the project.

- Operations – Consisting of running and maintaining the renewable energy project, the operations phase is lower risk. The operational period is 35 to 40 years and is attractive to investors seeking long-term steady cash flows.

How the Inflation Reduction Act Changes Project Financing

For the solar industry, the passage of the IRA provides a range of new opportunities in the form of tax incentives and federal tax credits. These incentives are crucial to utility-scale renewable projects because they allow for the financing of projects that may otherwise be too costly or speculative for any one investor to carry on their balance sheet.

The aspects of the IRA that will lead to more renewable energy deployment include:

- Expansions of existing tax credits – Solar projects are now eligible for Production Tax Credits (PTC), which were historically reserved for wind projects. Before the IRA, solar projects were limited to Investment Tax Credits (ITC), which were one-time credits claimed in the year the project was placed-in-service. In contrast, solar PTC is claimed every year over a 10-year credit period.

- Extensions of existing tax credits – The IRA restores the full rate of PTCs and ITCs for at least the next ten years, until 2032 assuming the prevailing wage and apprenticeship requirement is met.

- New tax credits – Standalone energy storage projects are now eligible for ITCs, creating new investment opportunities in energy storage.

- Tax credit adders – This change allows sponsors to get more of their investment back while also helping to create jobs, reduce our reliance on imports, and incentivize the transformation of brownfield spaces.

- New ways to monetize tax credits – Tax credits can now be sold to unrelated parties starting in 2023, increasing tax credit flexibility. Additionally, for the limited groups of investors that are eligible for the new direct pay proposals, developers can treat tax credits generated by a renewable energy project as equivalent to a payment of tax on the developer’s filed tax return.

This boost in renewable energy deployment will also create jobs and positively contribute to climate change. Over the next decade, the IRA is expected to create 200,000 jobs and offset an additional 747 million metric tons (MMT) of carbon emissions. Studies estimate that the IRA could help the United States achieve roughly two-thirds of President Biden’s 2030 carbon reduction goals.

As IRA benefits begin to impact the market, new players will enter the market. Project financing structures will shift and expand due to increased flexibility, which accommodates the economic preferences of different investor types. As an organization that evaluates project economics from the perspective of sponsors and owners, Redeux pays close attention to these trends.

Throughout market shifts and industry growth, project finance within the renewable energy sector will become even more nuanced and complex. It is important for all project sponsors and tax equity investors to work closely with experts and consultants who have a deep understanding of the process and can get renewable deals done.

With the changes mobilized by the IRA, the solar industry’s market value is projected to continue its impressive growth, driving an additional 222 gigawatts (GW) of solar over the next decade compared to a non-IRA scenario. That makes right now a better time than ever before to learn more about Redeux’s approach to development and project finance.

Are you interested in learning more about utility-scale solar project finance? Get in touch today.